Why Gold Prices Could Skyrocket

The price of gold could be set to jump. If you don’t own any gold already, it might be time to pay a little more attention to the yellow precious metal.

Long-term readers of Lombardi Letter have been alerted about the possibility of higher gold prices for years. We were calling the precious metal a lifetime opportunity when others were calling it a slam-dunk sell. We were saying patient investors could reap immense rewards from gold when others were calling the metal a useless asset.

So, why should investors be bullish on gold now? Here are three reasons that gold prices could go a lot higher than they are now.

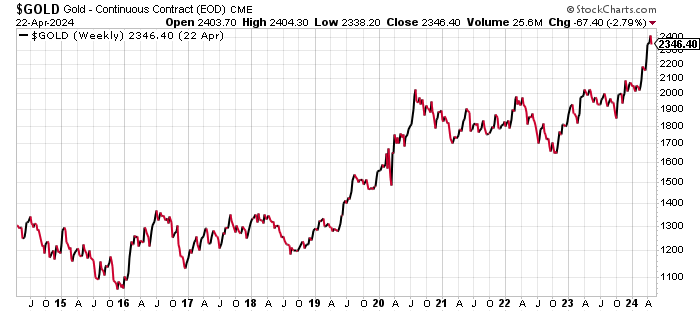

1. Gold Prices Hitting All-Time Highs

Much of the time, investors pay more attention to price than anything else. You could have one of the best ideas out there, but if the price of the asset isn’t moving, no one really pays attention. Once an asset starts increasing in value, you see a rush to buy.

Gold prices are now hitting all-time highs. With this, it’s possible that the yellow precious metal will get more attention, even from those who’ve been ignoring it.

For years, it’s only been central banks that have been loading up on gold. Gold allocations at the institutional-investor level have remained very low.

Chart courtesy of StockCharts.com

2. Demand for Gold Coming From Uncanny Places

Recently, gold has started to get attention from even average consumers. Demand for the precious metal has been coming from places you might not have thought of.

This is a bullish sign; it tells us there’s very little price sensitivity. Even at all-time high gold prices, people are willing to buy the metal.

Consider this: Costco Wholesale Corporation (NYSE: COST) has been selling one-ounce bars that are made of nearly pure 24-karat gold. Analysts at Wells Fargo & Co (NYSE:WFC) recently said that Costco could be making monthly revenues of anywhere from $100.0 to $200.0 million from selling gold.

Edward Kelly, an equity analyst at Wells Fargo, said the following in a note to clients on April 9: “The accelerating frequency of Reddit posts, quick on-line sell-outs of product, and COST’s robust monthly [e-commerce] sales suggests a sharp uptick in momentum since the launch.” (Source: “Costco Selling as Much as $200 Million in Gold Bars Monthly, Wells Fargo Estimates,” CNBC, April 9, 2024.)

This is nothing but good news for gold bugs.

3. Very Little Negativity About Gold

Usually, gold is a hated asset, meaning that, whenever gold prices move higher, you almost always have some major bank or famous investor calling it a useless asset or saying it’s in a bubble.

This time around, that hasn’t really been happening. In fact, big banks have been turning bullish on gold.

For instance, Goldman Sachs Group Inc (NYSE:GS) is now predicting that the price of gold will be around $2,700 an ounce by the end of 2024. They had previously projected prices of about $2,300 an ounce. (Source: “Gold Prices 2024 Outlook: Goldman Sachs Raises Its Forecast,” Investing.com, April 12, 2024.)

What’s Ahead for Gold Prices?

Dear reader, I’ve been bullish on gold for a while, and I’ve said several times that the price of the yellow metal could make a run toward $3,000 an ounce. I think the odds of that happening are increasing, and it could happen a lot sooner than many anticipate.

I think gold still represents an opportunity for investors.

One place that’s been missing in action lately is the gold mining sector. The prices of gold miner stocks have significantly lagged behind the price of gold. I think, however, they could be the next gold-related investment that investors rush to buy.

At $2,300-an-ounce gold prices, even some of the “bad” mining companies have been making money. A lot of miners are flooded with cash, and I think the mining sector is a boon for merger-and-acquisition activity.

Although gold mining stocks are risky, they could become the best-performing stocks in the next few quarters. I wouldn’t even be shocked if they beat the returns posted by key stock indices by a very large margin.